89.6%4,059,412 Clients

Upstox Account Opening Enquiry

Pay flat Rs 20 per trade for delivery, Intra-day and F&O. Rs 0 Demat AMC. Open Instant Account online and start trading today.

Upstox isUpstOx is a tech-first low cost broking firm in India providing trading opportunities at unbeatable prices. Company provide trading on different segments such as equities, commodities, currency, futures, options which are available on its Upstox Pro Web and Upstox Pro Mobile trading platforms.BAcked by a group of investors including Kalaari Capital, Ratan Tata and GVK Davix.

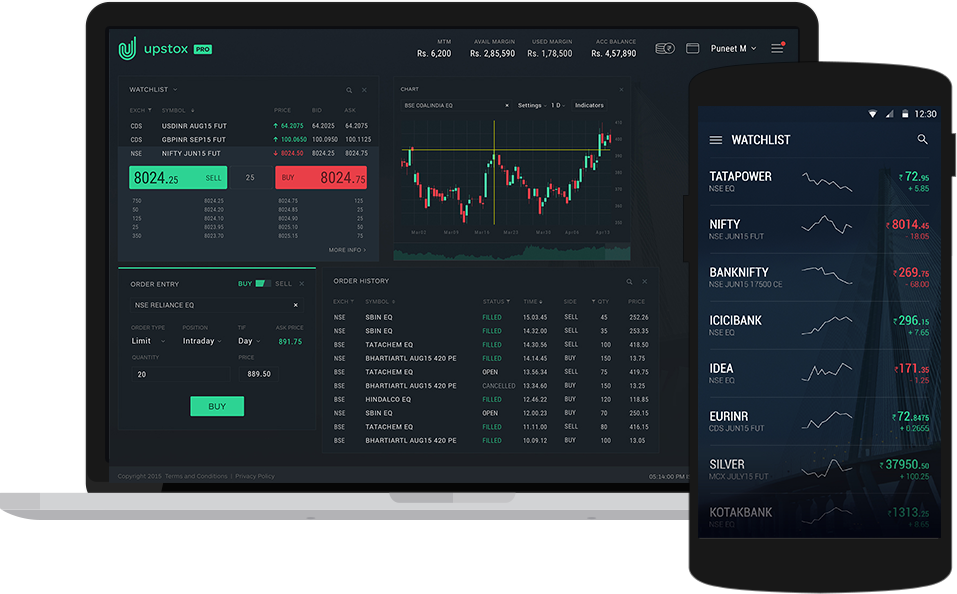

Upstox trading platform offers trading, analysis, charting and many more rich trading features. This platform makes it easy to place orders through mobile phones and web browser. Upstox trading platform is built on Omnisys NEST OMS (Order Management System) and Omnisys NEST RMS (Risk Management System).

Trading in Equity F&O, Equity Indra-day, Commodities and Currency Derivatives is available through Upstox Pro. Upstox Pro is the paid service of Upstox for traders.

Upstox Special Offers

Flat Rs 20 per Trade Brokerage

- Pay flat Rs 20 for Equity Delivery, Intra-day and F&O Trades.

- Pay Rs 0 Brokerage for Mutual Funds.

- Rs 0 Demat AMC.

- Trade with the best trading platform.

It is a limited-time offer. Open Instant Account online and start trading the same day.

Upstox Charges 2021

- Upstox Account Opening Charges: Rs 249

- Upstox Demat AMC: Rs 0 (Free)

Upstox Equity Delivery & Intraday Charges

Upstox equity delivery brokerage is Rs 20 or 0.1% whichever is lower per order. Upstox equity intraday brokerage is Rs 20 per executed order or 0.05% (whichever is lower).

| Upstox Charges | Equity Delivery | Equity Intraday |

|---|---|---|

| Brokerage | Rs 20 per executed order or 2.5% (whichever is lower) | Rs 20 per executed order or 0.05% (whichever is lower) |

| STT | 0.1% on both Buy and Sell | 0.025% on the Sell Side |

| Transaction Charges | Rs 325/crore | Rs 325/crore |

| Demat Transaction Charges | Rs 18.5 per scrip (only on sell) | Rs 0 |

| GST | 18% (on Brokerage + Transaction Charges) | 18% (on Brokerage + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Duty | 0.015% (Rs 1500 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

Upstox Equity F&O Charges

Upstox Equity F&O brokerage is Rs 20 per executed order or 0.05% (whichever is lower).

| Upstox Charges | Equity Futures | Equity Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| STT | 0.1% (on Sell Side) | 0.1% (on Sell Side) |

| Transaction Charges | Rs 210/crore | Rs 5500/crore on premium turnover |

| Demat Transaction Charges | Rs 0 | Rs 0 |

| GST | 18% (on Brokerage + Transaction Charges) | 18% (on Brokerage + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Duty | 0.002% (Rs 200 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

Upstox Currency Charges

Upstox Currency brokerage is Rs 20 per executed order or 0.05% (whichever is lower).

| Upstox Charges | Currency Futures | Currency Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| STT | No STT | No STT |

| Transaction Charges | NSE: 0.00013% | BSE: 0.00062% | NSE: 0.065% | BSE: 0.026% (on premium) |

| GST | 18% (on Brokerage + Transaction Charges) | 18% (on Brokerage + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Duty | 0.0001% (Rs 10 per crore) on buy-side | 0.0001% (Rs 10 per crore) on buy-side |

Upstox Commodity Charges

Upstox Commodity brokerage is Rs 20 per executed order or 0.05% (whichever is lower).

| Upstox Charges | Commodity Futures | Commodity Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| STT | 0.01% on sell trade (Non-Agri) | 0.05% on sell trade |

| Transaction Charges | 0.0031% | 0.002% |

| GST | 18% (on Brokerage + Transaction Charges) | 18% (on Brokerage + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Duty | 0.002% (Rs 200 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

Upstox Charge Explained:

- STT: This is charged only on the sell side for intraday and F&O trades. It is charged on both sides for Delivery trades in Equity.

- Stamp Duty: Charges based on the state the customer is located in.

- Goods and Services Tax (GST): This is charged at 18% of the total cost of brokerage plus transaction charges.

- SEBI Turnover Fees: This is charged at Rs 10 per Crore.

Other Charges (Upstox Broker Hidden Charges / Fees):

- Call & Trade: Rs 20 per executed order

- Physical contract notes: Rs 25 per contract note plus courier charges. (Digital contract notes are free.)

- Instant Money Transfer Fee: Rs 7 per tranfer

Upstox Online Account Opening

- To open an account with Upstox; please leave your information and Upstox representative will contact you.

Upstox Trading Software (Upstox Trading Platforms)

Upstox offers mobile and website based trading. Upstox's trading platform is build in-house by RKSV to make it extremely easy to place orders through mobile as well as web browser. As of now no trading terminal is available though Upstox.

Visit Upstox Trading Software Review for more detail.

Upstox Pros and Cons

Upstox Pros (Advantages)

The following are the advantages of Upstox. You must read Upstox advantages and disadvantages before opening an account with Upstox. Upstox pros and cons help you find if it suits your investment needs.

- Rs 0 Demat account maintenance charges.

- Flat Rs 20 per trade brokerage across all segment including delivery, intraday and F&O at BSE, NSE and MCX.

- Mobile trading app available for both Android and iOS phones. No software uses charges.

- After Market Order (AMO) and Cover Order are available on both web and mobile.

- Trailing-Stop/Stop-Loss (SL) is available in both web and mobile.

- Upstox Pro Web Trading Platform offers multiple indicators to monitor markets on-the-go.

- Upstox Bridge for AmiBroker helps you to code & execute your trading strategy using the AmiBroker AFL editor.

- Upstox Developer Console helps you build (code) your own trading app using languages such as Python.

- Upstox Option Chain Tool helps traders find out Spot, Future prices, vertical comparison of rates, get details such as circuit levels, Open High Low Close and market depth. It allows customers to measure volatility, open Interest, performance indicator and check greeks as well.

- Upstox MF Platform offers 1000's of Mutual Funds to invest in. Customers can choose Lumpsum or SIP pattern of investing.

- Margin Against Shares is available.

- Online IPO Application (UPI) is available.

Upstox Cons (Disadvantages)

The following are the cons of Upstox. Check the list of Upstox drawbacks.

- Equity delivery brokerage is Rs 20 per trade. Most other brokers offer brokerage free investment in stock market.

- Good Till Cancelled (GTC) and Good Till Date/Time (GTD) Orders are not available in Equity Segment. GTC/GTD orders are available in commodity trading.

- Margin Funding is not available on delivery trades.

- Upstox doesn't offer unlimited monthly trading plans.

- Call and trade fee is charged at extra Rs 20 per executed order (Rs 20 Brokerage + Rs 20 Call & Trade Fee).

- Additional Rs 20 per executed order is charged for Intraday square MIS/BO/CO orders when they are not square off by the customer.

- Doesn't provide stock tips or recommendations.

- 3-in-1 accounts are not available as company doesn't provide banking services.

- 24/7 customer service is not available.

- Upstox NRI Trading and demat account is no more available (since Jan 2018).

- Upstox doesn't offer API access for automated trading.

Upstox Margin Exposure

Upstox margin for intraday trading is up to 20% of trade value (max 5x leverage) based on the stock. Upstox F&O intraday trading margin is 1.3x across Equity, Currency, and Commodity trading at BSE, NSE, and MCX. There is no additional margin offered for Upstox F&O carry forward positions and equity delivery trades.

| Segment | Margin | Leverage |

|---|---|---|

| Equity Delivery | 100% of trade value | 1x |

| Equity Intraday | Up to 20% of trade value | 5x |

| F&O (Equity, Currency and Commodities) | 100% of NRML margin (Span + Exposure) | 1x |

Upstox Ratings

| Overall Rating | |

| Fees | |

| Brokerage | |

| Usability | |

| Customer Service | |

| Research Capabilities |

Based on 122 Votes by Upstox Customer

Upstox Complaint

The number of Upstox customer complaint received by the exchanges. The Upstox consumer complaint report helps understanding the Upstox quality and relibility of service.

| Exchange | Financial Year | Number of Clients* | Complaints** | % |

|---|---|---|---|---|

| NSE | 2021-22 | 4,059,412 | 327 | 0.01% |

| BSE | 2021-22 | 499,893 | 32 | 0.01% |

| NSE | 2020-21 | 2,141,095 | 862 | 0.04% |

| BSE | 2020-21 | 143,126 | 7 | 0% |

| NSE | 2019-20 | 619,305 | 164 | 0.03% |

| BSE | 2019-20 | 142,797 | 11 | 0.01% |

| NSE | 2018-19 | 92,781 | 58 | 0.06% |

| BSE | 2018-19 | 22,381 | 7 | 0.03% |

| NSE | 2017-18 | 43,889 | 35 | 0.08% |

| BSE | 2017-18 | 24,483 | 2 | 0.01% |

* The number of active customers reported by the broker.

** The total number of complaints received against the broker at the given exchange.

Visit Upstox Complaints at BSE, NSE and MCX for detail report.

Upstox Reviews

- Upstox Charges Review

- Upstox Mobile App Review

- Upstox Account Opening Process Review

- Upstox Demat Account Review

- Apply in IPO through Upstox

- Upstox Branch Offices / Sub Brokers / Franchise

- Upstox Trading Software Review

- Upstox NRI Account Review

- Upstox Mutual Fund Review

- Is Upstox safe for trading and long term investment?

- Upstox API Review (Algo Trading)

- Upstox Complaint Monitor

- Upstox FAQs

0 Comments